The Ultimate Guide to Comparing Debt Consolidation Loans

Navigating the maze of debt consolidation loans can feel like searching for a needle in a haystack, an important, financially life-changing needle. If you're searching for the best debt consolidation loans, it's crucial to cross the t's and dot the i's of your decision-making process. Knowing how these loans work and what to look for in a lender is your compass to a smart choice.

Allow this guide to be your trusty map to the complex financial landscape of debt consolidation loans. We'll walk you through comparing lenders and even extend our view beyond debt consolidation products so that you can make a well-informed financial decision.

How a Debt Consolidation Loan Works

A debt consolidation loan can help you pay off existing credit card debt, loans, and more by combining them into one larger loan. It can reduce the expense of high-interest debt and make it easier to manage with one monthly payment. Once your debt consolidation loan application is approved, you will receive the loan funds in your bank account within a few business days, allowing you to pay off your existing debt.

Before taking out a debt consolidation loan, weigh the advantages and drawbacks. Here are some pros and cons to consider:

Pros

-

Lower Interest Rate: Consolidation Loans often have a lower interest rate than standard unsecured loans. This means you can save money and pay off your debt faster.

-

Single Monthly Payment: Instead of juggling multiple payments, consolidate debt and enjoy only having one monthly payment. Consolidating debt simplifies your finances by saving you from remembering the monthly payment date of multiple accounts.

-

Simplicity: Consolidation loans can provide a one-stop solution for taking care of multiple debt obligations, saving you time and stress.

Cons

-

Duration: It may take longer to pay off the loan than just paying off individual debts separately.

-

Fees: The lender may charge fees such as origination or application fees.

-

Credit Score: Any action you take will affect your credit score. In the short term, you may see a drop in your credit score.

Consolidation Loans Compared to Personal Loans

Consolidation loans are similar to personal loans, but several meaningful differences exist.

Personal Loans

A personal loan is intended primarily for financing a specific need or a one-time expense. Personal loans usually have an interest rate fixed for the loan's life, making them easy to budget. However, it can be challenging to qualify for a personal loan if you have alot of debt, and the don't usually provide debt relief options such as repaying your old accounts or balance transfers.

Consolidation Loans

Consolidation loans are issued for just the amount needed to repay existing debt. The money from debt consolidation loans is intended exclusively for debt consolidation.

Interest rates may vary from loan to loan, and they should be lower than the average of the debt's you are consolidating. If not, you'll want to consider options beyond debt consolidation.

Consolidation loans offer payment flexibility and convenience, allowing you to pay your bills with one monthly payment. Additionally, if you keep up with the payments, consolidation loans can help improve your credit score by showing lenders that you are taking steps to get out of debt. Debt consoildation loan requirements tend to be easier on people with higher debt-to-income ratios (DTI).

Some lenders may require collateral. When collateral is required, the loan becomes a secured consolidation loan. Not all consolidation loans are secured, so discussing this with your lender is important.

Repayment terms depend on your creditworthiness and generally range from two to five years. It is important to note that if you default on any loan, the lender may repossess the assets that secured the loan to recoup their loss.

Debt Consolidation Loan Qualification Requirements

When researching loan options, you'll want to understand the qualifications of each lender. While many lenders have common requirements, such as a minimum credit score or income level, others may be more detailed and inquire about additional financial information.

Qualification requirements will also vary depending on the amount and type of loan you're looking for. For instance, some lenders specialize in secured loans, while others might require you to meet specific debt-to-income ratio requirements.

If you thoroughly research each lender's qualifications before applying you'll avoid unnecessary denials and set yourself up for a smooth application process.

Loan Terms and Interest Rates

Debt consolidation loan terms can vary significantly, so it pays to look at the details to fully compare loan options.

Generally speaking, the longer the loan term, the lower your monthly payments. However, this could mean paying more in interest over the life of the loan. On the other hand, if you opt for a shorter loan term and higher monthly payment, you could pay less in interest overall.

You should also pay close attention to how lenders calculate and apply debt consolidation loan interest rates. In some cases, the APR you qualify for may be higher than advertised, depending on factors such as your credit score or DTI.

Loan Fees and Charges

In addition to interest rates, you'll want to consider any fees or charges that come with the loan. These could include origination fees, late payment penalties, closing costs, etc. Some lenders may also charge a prepayment penalty if you repay your loan early.

Consider all potential costs of each loan so you can factor them into your decision and budget accordingly.

Flexible Loan Terms

Finally, flexibility should also be a consideration when comparing lenders. Different lenders offer different payment options; for example, some may allow you to make biweekly payments instead of monthly.

In addition, some lenders may provide additional features such as repaying your consolidated debt for you, changing your payment due date, or accessing an overdraft feature if needed.

Take the time to find the right consolidation lender and compare all the loan options you can. Be through to secure a debt consolidation loan that meets your unique financial needs.

Origination Fees

An origination fee is a fee the lender charges to process your loan application. Average debt consolidation origination fees may be an upfront, one-time charge or a percentage of the loan amount. It is important to check and compare the costs of each loan so you can factor them into your decision and budget accordingly.

Total Loan Amount

Not all debt consolidation loans and lenders are created equal. Most lenders have loan ranges that they tend to offer. A debt consolidation loan should not be a partial solution. Otherwise, you'll still be left with debt to tend to. It's important to know how much you need before choosing a lender and don't settle for a partial solution.

Customer Support

Top Debt Consolidation Loan Providers will have a proactive customer service team that is available to answer questions and help resolve any issues that may arise. Look for lenders who put clients first and have an experienced customer support staff who can advise when needed.

The best debt consolidation lenders will not just issue a loan; they'll offer resources to help you improve your broad financial situation.

Top Debt Consolidation Lenders

The next section will explore the market's top debt consolidation loan providers. IAPDA provides certification and education to debt advisors within the debt settlement industry. IAPDA does not accredit debt consolidation lenders, but we recognize debt consolidation loans as a valuable debt solution for many consumers. We've researched the market to bring you an overview of well-known lenders to support you in making an informed decision on who to choose for your debt consolidation loan.

Best Egg

Best Egg is best for short repayment terms. APRs range from 8.99%–35.99% plus an origination fee of 0.99%–8.99% of the loan amount.

Best Egg charges an origination fee of at least 4.99% on loans with terms of 4 years or longer. Qualifying for their lowest APR will require a minimum credit score of 700 and a minimum individual annual income of $100,000

LightStream

LightStream is regularly found to be a top debt consolidation lender. The maximum APR for a LightStream loan is 25.99%, with loan terms ranging from 24 to 144 months, depending on the loan type.

LightStream offers an AutoPay discount to capture a .50% discount, though it is only available before loan funding. LightStream stands out for its Rate Beat Program, demonstrating its commitment to providing customers with the most competitive rates. However, borrowers need to know that rates and terms may vary based on their creditworthiness.

SoFi

SoFi is a popular lender for debt consolidation loans and student loan consolidation. Loan amounts range from $5,000–$100,000. As a large online lender, SoFi offers competitive interest rates and emphasizes customer service. The APR ranges from 8.99% to 25.81% APR, and an origination fee of 0%-6% is deducted from your loan proceeds.

SoFi offers a 0.25% interest rate reduction for borrowers who enroll in autopsy. Though they prefer borrowers with good or excellent credit, SoFi may also consider borrowers with fair credit depending on other financial factors. Additionally, they offer an Unemployment Protection Program, which allows borrowers to temporarily pause payments on the loan agreement if they lose their job. Overall, SoFi provides competitive rates and terms for those looking to consolidate credit card debt, refinance student loan debt, and more.

Credit9

Credit9 offers a wide selection of debt consolidation loan options with competitive interest rates and flexible terms. Loans range from $2,500 to $45,000, and APRs are not clearly published as they are with other lenders and brokers. Credit9 is accredited by the BBB, presently holds an A+ rating, and has numerous positive Credit9 reviews.

The Credit9 career page is hiring debt negotiators and settlement specialists, meaning this lender may have a debt settlement division. Debt settlement is an effective way to resolve credit card debt, but it can result in bad credit and should only be facilitated by licensed and educated professionals. If you are reaching out for an unsecured personal loan and are offered a debt settlement program to resolve existing debt, be sure to understand exactly what the service entails. If they offer a debt settlement service, be sure to search the cert' below to be sure any company or advisor is IAPDA accredited and adheres to state and federal regulations.

Debthunch

Debthunch offers to connect you to a network of lenders and debt consolidation loan providers. With Debthunch, you can consolidate credit cards, unsecured personal loans, medical bills, collections, and business loans.

Its partners pay Debthunch a fee for their administrative assistance in helping you obtain the loan. Debthunch promises a quick online application process and currently holds an A+ rating with the Better Business Bureau.

Debthunch does not presently have rates published. However, they promise competitive rates and assistance from experienced loan professionals.

Debt Consolidation Lead Generators

Debt consolidation lenders aren't alone in issuing loans to consumers. Consolidation loan brokers and lead generators act as matchmakers between debtors and debt consolidation loans. The trouble is, it can be hard to tell which companies are legit and which ones aren't.

IAPDA suggests hand-selecting the just-right lender for you. Still, if you are having a tough time qualifying with traditional lenders or want to compare multiple loans and lenders at once, a loan broker may be helpful for you.

Working with a third-party debt consolidation lead generator has an extra level of risk.

Those who are reputable are transparent about their processes and fees, and they prioritize connecting customers with debt consolidation lenders that meet their financial needs. Those who are not reputable may sell your information out the back door or originate a loan that provides them a higher commission rather than the one that best meets your needs.

It's best to be aware of the risks before making a decision. Research the company, read reviews, and ask plenty of questions to ensure you understand what services they offer and how much they will cost you. That way, you can avoid any unpleasant surprises down the road.

Examples of Debt Consolidation Brokers

Like most businesses, consolidation loan brokers come in all shapes and sizes. Familiarize yourself with any company you are considering by reading their terms and conditions, asking what lenders they send your application to, and researching their reputation online.

TriPoint Lending

Tripoint Lending is both a loan broker and a California-licensed finance lender. TriPoint Lending provides loan amounts from $5,000-$100,000 with annual percentage rates (APRs) ranging from 5.99% APR to 35.99%.

To qualify for the lowest rate offered by TriPoint Lending, you must meet certain criteria, such as having a good credit report and history, a DTI that does not exceed 50%, and being employed for at least one year.

Simple Path Financial

Simple Path Financial is a direct lender and a loan referral service that helps consumers find the best debt consolidation lenders. They offer borrowers access to 10+ lending institutions and provide a comprehensive application process with no upfront fees.

Simple Path Financial provides loan amounts from $5,000-$100,000 with APRs ranging from 7.99% APR.

Debt Consolidation Lenders with Poor Reviews

At IAPDA, we're committed to helping consumers find the right solutions to solve their financial hardship.

Unfortunately, there are some bad actors in the debt consolidation industry. It is important to be extra cautious when considering a lender with multiple or especially poor reviews. IAPDA does not endorse or promote any debt consolidation lender referenced, and we encourage you to do your due diligence on any lenders. That said, we encourage you to take extra care to research companies with a history of negative reviews from their borrowers.

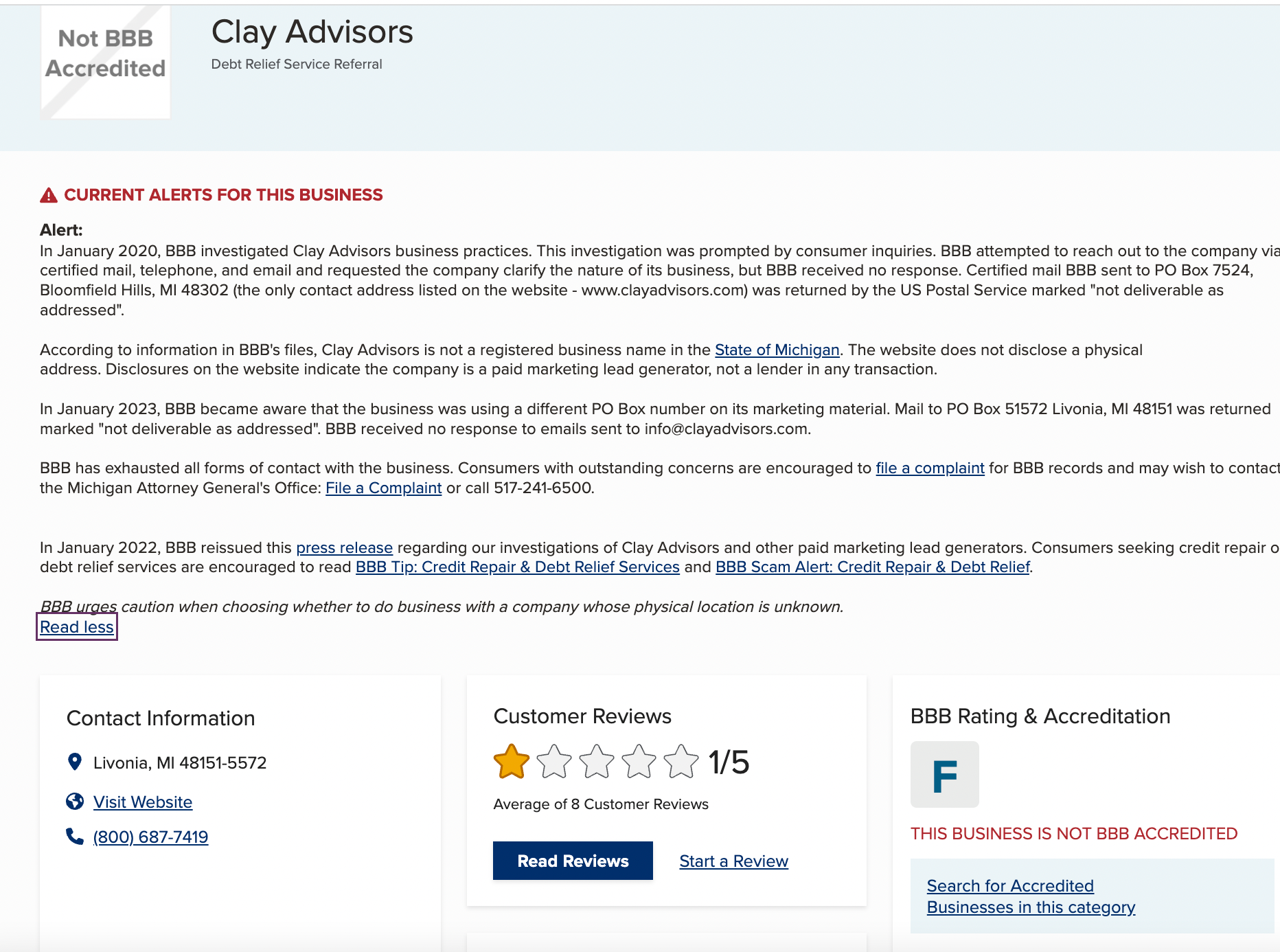

Clay Advisors

Clay Advisors is a debt consolidation lead generator that connects borrowers with up to 4 participating financial institutions. Clay Advisors is not BBB accredited, and from the reviews on the BBB, several issues have been highlighted by borrowers and potential borrowers alike that raise worry of a Clay Advisors scam.

Reading through Clay Advisors reviews showed that one concern stems the unsolicited communication from the company, often perceived as spam, with some customers highlighting that they receive junk mail from Clay Advisors despite having no debt.

There's also suspicion of the company engaging in a scam operation, with customers complaining about the company harvesting personal contact information, then selling it to other debt consolidators. Some customers claim to have received deceptive pre-approval letters only to be offered higher interest rates upon contacting the company, leading to allegations of bait-and-switch tactics. Additionally, there are allegations of discriminatory practices with the company refusing to attend to a customer with speech issues.

Sometimes we need to take customer reviews with a grain of salt, but it's advisable to research any lender thoroughly before making any commitments.

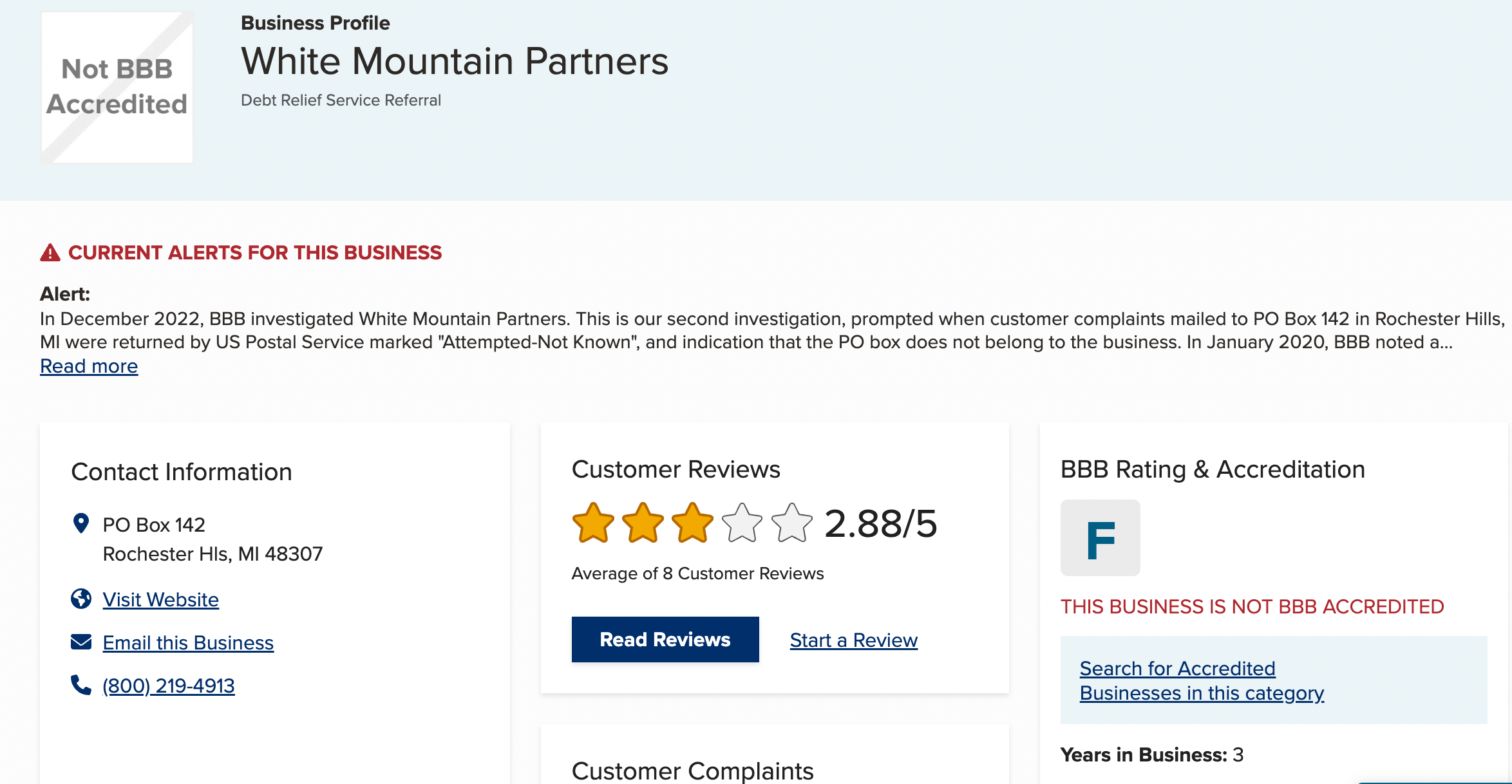

White Mountain Partners

White Mountain Partners is a debt consolidation lead generator that connects borrowers with up to 4 participating financial institutions. The lender emphasizes customer education and provides resources to help consumers understand the process of debt consolidation, as well as how lenders make decisions about loan approval and terms. White Mountain Partners does not charge customers an upfront fee for this service; however, they likely receive compensation from participating lenders when they issue a personal loan.

White Mountain Partners is a debt consolidation lead generator that connects borrowers with up to 4 participating financial institutions. They emphasize customer education and provide resources to help consumers understand the debt consolidation process and how lenders make decisions about loan approval and terms. White Mountain Partners does not charge customers an upfront fee for this service; however, they likely receive compensation from participating lenders when they issue a personal loan.

At the time of this writing, White Mountain Partners has an F rating with the Better Business Bureau and an alert regarding the company. Several customer complaints on the BBB complain about poor customer service from White Mountain Partners and not being able to contact them after payment for services was already made.

While exploring White Mountain Partners' reviews, we found that several customers have expressed dissatisfaction with White Mountain Partners in their reviews. There appears to be a significant issue with customer service, with representatives reported to be impatient and dismissive when customers ask questions about the loan process.

Some people worried of a White Mountain Partners scam have reported feeling uncomfortable with the company's request for personal information. Reports of instances where the company has failed to keep scheduled appointments left clients feeling uncertain and unsupported. Some reviewers also claimed the company was a scam, with one particularly detailed review citing its lack of BBB accreditation, physical address, and poor BBB rating as warning signs.

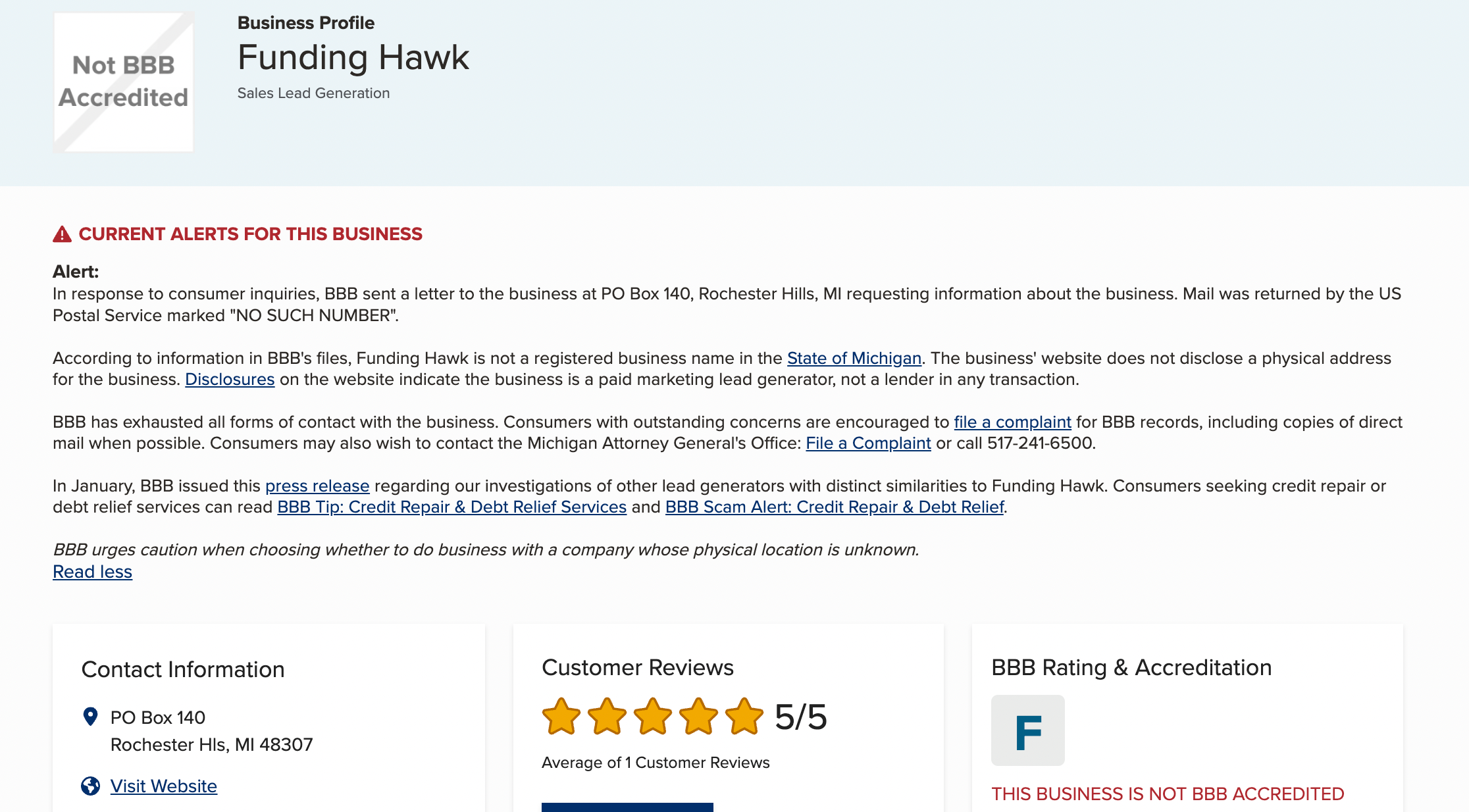

Funding Hawk

Funding Hawk is a debt consolidation broker and loan referral service that helps match borrowers with lenders. They promise to offer loan amounts of up to $20,000 in as little as 48 hours and have APRs ranging from 6.99% APR to 35.99%.

The BBB presently shows Funding Hawk as having an F rating. The BBB also has several alerts to warn consumers about the questionable business practices of Funding Hawk. These include a lack of physical address and BBB accreditation, as well as several negative reviews from customers claiming they received poor customer service. Additionally, there have been reports of a Funding Hawk scam of charging exorbitant fees for their services without providing any value in return.

Qualifying for the Best Debt Consolidation Loan

The best debt consolidation loans are going to have the most strict eligibility criteria. Before approaching personal loan lenders, borrowers should expect to present lenders with various documents and information. Here are the areas you'll want to focus on to put your best foot forward when applying for a debt consolidation loan.

Get Your Credit in Order

The surefire way to score the best consolidation loan rates is by stepping forward with a strong application and a good credit score. Maintaining a good credit score will give you access to the best interest rates and terms available.

What Makes a Good Credit Score?

A good credit score begins by understanding what makes up your FICO score.

Your FICO credit score generally considers five factors: payment history (35%), total amount of debt owed (30%), credit history length (15%), new accounts (10%), and mix of types of credit used (10%).

Pay your bills on time, maintain a low overall balance, and keep old accounts open while opening newer ones responsibly.

Show a Stable Source of Income

Your credit score tells an important part of your story, but since lenders also want to ensure you can repay the loan, proof of income is essential. Gather your most recent pay stubs, tax returns, and possibly bank statements that prove ongoing deposits.

If you aren't in a traditional employment setting, you'll need to jump through a few extra hoops to qualify for a personal loan. You'll likely need to gather a profit and loss statement, statements showing deposits into your bank account, contracts to show long-term engagements, or other documents to prove income stability.

The stability of your income matters, too. It may be more difficult to qualify for the best debt consolidation loan rates if your income is not documented, varies (like a seasonal job in the off-season), or you're in between jobs or haven't been with your employer very long.

Calculating Your Debt to Income Ratio

Your debt-to-income ratio helps lenders decide if you qualify for a loan. You can calculate your DTI by dividing your total monthly debt payments by your gross monthly income. Lenders generally prefer a ratio of 36% or less.

Tips for Comparing Debt Consolidation Loans

Now that you understand the basics of both debt consolidation loans and personal loans, here are some tips to keep in mind when comparing lenders:

-

Compare different offers to get the best debt consolidation loan rate.

-

Consider fixed and variable interest rates to see which works best for you.

-

Read the fine print to avoid hidden fees or other surprises.

-

Check if the lender charges prepayment penalties or late fees; some lenders will waive these fees if you're a loyal customer.

-

Choose a lender that is transparent about its processes and has a proven track record of customer satisfaction.

-

Make sure the lender you choose is licensed in your state.

-

Check if the lender offers any financial education tools to help you understand debt consolidation loans better.

-

Research customer feedback from online review sites and social media platforms before deciding.

-

Ask about discounts for people using autopay or early loan repayment.

-

If you have any questions, don't hesitate to contact the lender's customer service before applying for or accepting any loan.

Choose the Right Lender

Applying for a loan that is out of reach and being declined hurts your credit and makes it harder to qualify when you do find the right lender. Different lenders have different criteria for who they lend to, so you'll do yourself a huge favor by becoming aware of what qualifies you for a loan with certain lenders. Research a lender's underwriting requirements or talk to customer service representatives at different companies if you're still unsure after reading their terms and conditions.

Alternatives to Debt Consolidation Loan

There are other options you can consider if a debt consolidation loan is not the right fit for you. Here are some alternatives to explore:

Debt Management Plan

A debt management plan (DMP) is an agreement between you and your creditors to pay off all of your debts in full but with reduced interest rates or waived fees. It works best if you have unsecured debt like credit card debt. It also requires discipline and willingness to work with your creditors; if you don't follow through on the plan, you may end up with worse terms than before.

Debt Settlement

Debt settlement involves negotiating with creditors to settle an account for less than the full balance owed. Debt settlement is proven to be an effective way to reduce debt. However, enrolled accounts do fall behind under settlements are reached, so it may harm your credit score.

IAPDA certifies and educates debt advisors. For help with debt settlement, search the cert' with IAPDA to ensure you're speaking with a knowledgeable debt advisor familiar with smart strategies to end debt.

Bankruptcy

Bankruptcy provides a legal solution for a person or business who cannot repay their outstanding debts. The bankruptcy process usually begins by working with a bankruptcy attorney to file a petition with the bankruptcy court. Bankruptcy can provide individuals and companies with a way to deal with debt that they cannot pay and give creditors a fair way of obtaining repayments. The proceedings can end up with the debtor being relieved of the financial obligations entirely, as with a Chapter 7, or it may follow a plan to repay a portion of the debt over time, as in a Chapter 13 bankruptcy.

Bankruptcy can resolve most unsecured, but the process will affect your credit score and history for years. Before filing for bankruptcy, consult a bankruptcy attorney familiar with your state laws. They can advise you on whether bankruptcy is the right choice, help you understand the process, and guide you through each step.

Conclusion

Navigating financial challenges can be stressful, but remember, you are not alone. The journey toward financial stability is within reach, and the first step is to educate yourself about the options available. As you explore the various debt consolidation and personal loan lenders and brokers, remember that guidance from a certified expert can be invaluable in this complex process. IAPDA-certified debt specialists have the knowledge and expertise to help you find a solution that suits your unique financial situation.

Take a moment to search the cert' at IAPDA to get connected with an IAPDA-certified debt specialist. Empower yourself by taking that first step today. Your path to financial freedom is just a click away.