Credit Card Debt

When getting out of debt there is no "one size fits all" solution. The best solutions depend on variables such as the amount you owe, your current credit score and your ability to re-pay.

One of the best investment strategies is to eliminate high interest debt. Credit card interest rates are high compared with other types of financing. A way to avoid the high rates is to pay off your statement balance before the next billing cycle. If you pay your entire bill each month, your purchases will be interest free. This style of money management, while fundamentally sound, unfortunately is seldom practiced. We’ll show you how to create a payment schedule and stay away from the monthly minimum payment trap.

Understanding your credit card Debt Relief options

Revolving Credit vs Installment Loans

Revolving credit allows the creditor to repeatedly borrow against and pay off a credit line up

to a certain

credit limit, without having to apply for a new loan. Simply put, when payments are made the paid

off amount becomes

available again to borrow as needed. Interest is paid on the amount borrowed not on the entire

credit line.

The most common examples of revolving credit are credit cards, personal loans and a home equity line

of credit

(HELOC). A preapproved amount of credit is extended, and interest is paid on the portion of money

used.

Installment loans (mortgages, car loans, student loans) give a lump sum of money with a fixed

amount and

schedule of payments until the loan is paid off. Once the loan is paid in full, the account is

closed.

Installment loans will generally have lower interest rates and a more stringent qualification

process.

Installment Credit

- Fixed Payments

- Set period of time to repay

- Ser or varying interest rates

- Car loans and home loans re typical examples

Revolving Credit

- No stated payoff time

- Limit to credit

- Minimum monthly payments

- Interest rates may vary

- Finance charges

- Credit cards most common example

How do I use my credit cards responsibly?

The average American gets their first credit card between 18 and 20 years old. Many, young and old, may not understand how to use credit cards wisely (how to avoid the minimum payment trap, how many cards to have at one time, how much credit to use) which can lead to bad spending habits, financial trouble and poor credit scores.

Many young and older people alike have little knowledge of how their credit card usage is evaluated by the credit bureaus. There are basic rules that everyone should follow when using credit cards to help boost their credit score while stay withing budget.

How much credit card debt should I be carrying at one time?

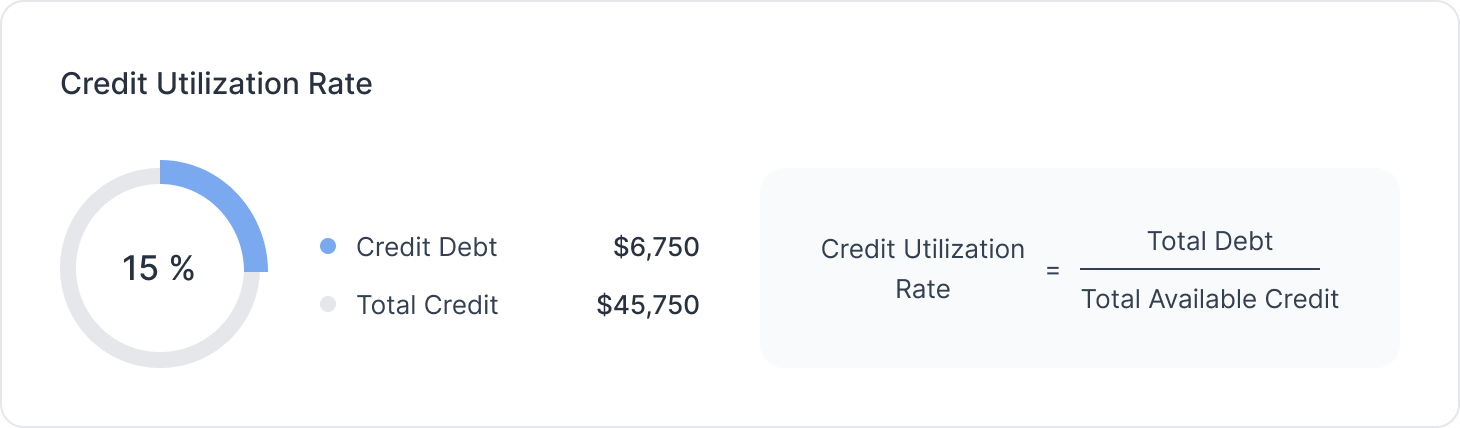

One of the least understood but most important factors of a credit score is the credit utilization rate. This factor accounts for 30% of your overall credit score and is a clear indicator of your spending habits. Keeping your credit utilization rate low will assure lenders that you don’t spend beyond your means.

Credit Utilization Ratio

A credit utilization ratio is the percentage of a borrower's total credit currently being used. For example, if you have two credit cards, one with a $7,500 limit and the other with a $2,500 limit, you have $10,000 in credit available. If you have a balance of $4,000 on one card, your credit utilization rate is 40%. You’re using 40% of the total credit available to you.

Credit utilization ratios are calculated strictly on revolving credit (credit cards, personal loans, HELOC), installment loans (car or home loans) are not part of the equation. Your ratio should not exceed 30%. Remember, 30% should be viewed as a maximum to avoid significant negative impacts on your credit score. The lower your ratio the better it is for your credit score, 10% or below is perfect position.

How many credit cards should I have?

The amount of credit cards someone should have depends on personal needs and spending habits. Some need different cards to help follow a budget and/or separate personal and business expenses. There’s no magic number, however a good rule of thumb to follow – how many cards am I able to keep track of and pay off on a monthly basis without carrying a balance each month. On average, people have three credit cards.

Multiple credit cards can help improve your utilization percentage if your spending habits are kept in check. Another advantage of having multiple credit cards is earning maximum rewards, having a backup card if one is stolen or lost and even saving on interest with balance transfers from higher to lower interest rate cards.

Avoiding the Minimum Payment Trap

Monthly Payment Options

The minimum monthly payment due is the lowest amount a credit card issuer will accept as a payment to keep a cardholder in good standing each month, typically 1-3% of your balance. Paying the minimum payment will keep you current and in good standing, avoiding any late fees.

Paying the minimum monthly payments will help you avoid fees and protect your credit score, but it will do very little to reduce your debt or boost your credit. You’ll be in debt for a longer period, and you’ll pay more in interest. This is what’s known as “the minimum payment trap” - keeping you in debt longer, costing you more money in the long run.

In times of financial crisis or an emergency, it may be necessary to make minimum payments. If you find yourself in a financial situation, paying the monthly minimum can be a life saver. This is a short-term solution that should not become a long-term payment habit.

Paying the minimum is the least aggressive debt payoff method. Not all of your payment always goes toward the principle, a portion of it will go toward interest.

The current balance will reflect the total amount that you owe on your credit card. Paying this amount every month keeps your utilization ratio low and minimizes the amount of interest you’ll pay.

The statement balance is the total balance on your account for that billing cycle. Your credit card billing cycle will typically last anywhere from 28 to 31 days. The number of days in each month varies so the number of days in your billing cycle may fluctuate month to month. There are regulations set for by the Consumer Financial Protection Bureau to ensure that they are as equal as possible.

According to the CARD Act, your due date is required to remain the same every billing cycle. And your due date must be at least 21 days from the end of a billing cycle, giving you time to budget your payments.

Paying Off Credit Card Debt – Debt Elimination

Adjusting your budget is the first step when deciding to pay off your cards. You’ll need to remove ANY unnecessary expense to increase your monthly cash flow for additional card payments. Once you’ve reduced your debt to your expectations, you can adjust your budget to include the additional expenses previously cut.

When eliminating credit card debt, it’s best to pay off one card at a time while maintaining your minimum payments with your remaining cards. Focusing on lump sum payments to one card is more effective than spreading your payments out. For every card that you pay off, you’ll be building additional cash flow that can be applied to the next debt.

Option 1 – Payoff the cards with the highest interest rates first

The first option to paying off your cards one at a time is to begin with the cards that have the highest interest rates first, working your way down accordingly. The idea is that the high interest cards will cost you more money and should be paid off first.

Option 2 – Payoff the cards with the smallest balances first

The second option is to pay off the cards with the smallest balances first and work your way up to the cards with the highest balance. Proponents of this method do acknowledge that you will end up paying more in interest payments. However, the “small wins” are a great way to keep you in the game mentally and to keep you motivated.

Once your cards are paid off, some will suggest the new goal is to maintain paying off your full balance early, before a statement is generated. When you pay the balance in full, your next statement will show a zero balance.

Some suggest leaving a balance on your cards rather than paying them off. It’s generally a better idea to pay off a balance instead of revolving the debt. According to the CFPB (Consumer Financial Protection Bureau), it’s a myth that you should leave a balance on your credit card to help your credit.

Keep Up the Good Work

You adjusted your budget, you’ve reduced your debt to an acceptable level, now it’s time to set new goals to maintain your newly attained financial freedom.

A great place to start is by keeping your spending in check and your balances low. This will make it easier for you to pay off your balances in full every month. If paying in full is not always an option, make it a priority to always pay more than the minimum payment, and if possible, suspend the usage of a card with a carry-over balance until the balance is paid in full.

Check your bills against your budget every month, make adjustments if need be and STICK to the program!

Click this link for information about personal budgeting:

How To Create A Budget

Click this link for information about family budgeting:

Budget For Families

Click this link for information about budgeting for couples:

Budget For Couples

Understanding Your Credit Card Debt Relief options

As we’ve mentioned, when getting out of credit card debt there is no “one size fits all” solution. Every situation is different. When simply budgeting by itself does not work as an option to pay off your credit card debt within a reasonable timeframe, the best solutions depend on variables such as the amount you owe, your current credit score and your ability to re-pay.

Credit Card Debt Relief Options to Consider

Contact your lender. First, try reaching out to your creditors to see whether they'll work with you.

1. Credit Card Deferment

Credit card deferment is when a credit card issuer agrees to temporarily suspend payments that a customer is required to make. This can be a great way for customers to manage their debt if they are temporarily unable to make the required monthly payments. A deferred payment plan can also help prevent any added interest or late fees. To qualify, you’ll need to prove you’re in financial hardship and give a realistic time to resume repayments.

2. Ask for forbearance

Asking for forbearance from a credit card company is when you request that they temporarily reduce the payments you are required to make due to a financial hardship. The credit card company may agree to this to help you get back on track with your payments and avoid any added interest or late fees. However, it's important to note that although forbearance can be a helpful way to manage your finances during a difficult time, it is not a long-term solution, and you will still be responsible for the debt at the end of the deferment period.

When the time arrives that a consumer decides that additional help is needed and working with a professional is your best option, there are several different options to help you get out of your financial problems.

Credit Card Debt Relief Options

Debt Consolidation Loan

Banks, credit unions, and installment loan lenders may offer debt consolidation loans. These loans collect many of your debts into one loan payment. This simplifies how many payments you must make. These offers also might be for lower interest rates than you are currently paying.

A debt consolidation loan strategy is a way to combine all your debts into one loan with a lower interest rate. This can help you save money by paying lower monthly payments and reducing the total amount of interest paid over time. Additionally, consolidating your debts into one loan may make repayment more manageable as you only must keep track of one payment. Some lenders may have restrictions requiring you to close your credit cards to secure the loan. While your credit score may take a hit, you will save money.

What Is Debt Consolidation?

Debt Consolidation is the process of combining several debts from credit cards, high-interest loans, and other bills into one monthly payment.

Pros:

- Reducing the interest rate and the total amount of debt owed.

- The amount of debt taken on with a consolidation loan will be lower than the combined amount of the original debts, and you can typically expect to pay a lower interest rate.

- Additionally, having a single loan can make repayment more manageable and help you avoid any late fees or added interest.

Cons:

- May not lower interest rates.

- Taking out a consolidation loan can negatively impact your credit score, as it will increase the amount of debt on your credit report.

- Depending on the type of loan you take out, there may be additional risks to your credit score, such as if you miss payments or fail to pay the loan in full.

- It's important to remember that success with a credit consolidation loan will depend on your ability to repay the new loan in a timely manner and stick to a budget.

Pros

- Simplify Debt Repayment

- Fixed Monthly Payment

- Lower Your Interest Rate

- Repay debt More Quickly

- Improve Your Credit (Possibly)

Cons

- Doesn’t Always Improve Credit

- Not a Magic Fix/Avoids the Root Issue

- May Not Lower Interest Rate

Credit Counseling/Debt Management Plan

Credit counseling is the process of working with a credit counselor who will provide advice and assistance on how to manage your finances and budget for the future. Credit counselors can also help you develop a repayment plan to pay back your debt over a period of time.

After assessing and determining the current financial situation and developing a budget with the

consumer, a credit

counselor may recommend a Debt Management Program.

After developing a budget, a consumer credit counseling agency will typically take the following

steps to set up a

debt management program:

- Negotiate with creditors to reduce interest rates, penalties and/or payment amounts.

- Set up a debt repayment schedule once the creditors agree to receive payments through the program.

- Receive one monthly payment from the consumer and distribute payments to the creditors as agreed.

Advantages of a debt Management Plan

Structured Payments

Secure Lower Interest Rates

Consolidate & Pay Off Loans More Quickly

Improve Credit Over Time

The amount of debt paid back when in a debt management plan will vary depending on the specific agreement made between the customer and the creditor. In general, customers can expect to repay 100% of the debt, however the benefit is the reduction or elimination of interest charges and fees allowing the consumer to get out of debt faster.

Pros:

- Under a debt management plan, you typically pay off all your existing accounts within five years.

- Reduced interest rates and/or payment amounts if your credit allows you to qualify for the best rates.

- Having only one payment can make it easier to manage your money.

- Debt consolidation may improve your credit utilization, which could help your credit score.

Cons:

- It is not a guaranteed solution as creditors may not agree to reduce payment amounts or interest rates.

- While enrolled in a debt management plan, you typically cannot open any new lines of credit, such as an auto loan or a personal loan.

- Debt consolidation is likely not a helpful strategy for individuals with lower credit scores who do not qualify for the best interest rates.

- Consolidation involves opening a new account, which has a slight negative impact on your credit score. If you also leave old accounts open, you may have significant credit available, which could create problems if it causes you to spend more and overload your credit.

Consumer Credit Counseling Programs

The amount of debt paid back when in a debt management plan will vary depending on the specific agreement made between the customer and the creditor. In general, customers can expect to repay 100% of the debt, however the benefit is the reduction or elimination of interest charges and fees allowing the consumer to get out of debt faster.

Benefits of Consumer Credit Counseling

- Reduces interest rates on each credit card (could be reduced to as low as 8%)

- Consolidates payments into a single payment

- Become debt free in 4.5 to 5 years

- Stops creditor calls because payments are made "on time" every month

- Credit score shouldn't drop

Downside of Consumer Credit Counseling

- Minimal monthly payment reduction compared to minimum payments

- 3rd party notation on credit report

- Only credit card debt qualified

- Inflexible payment terms

Credit/Debt settlement program

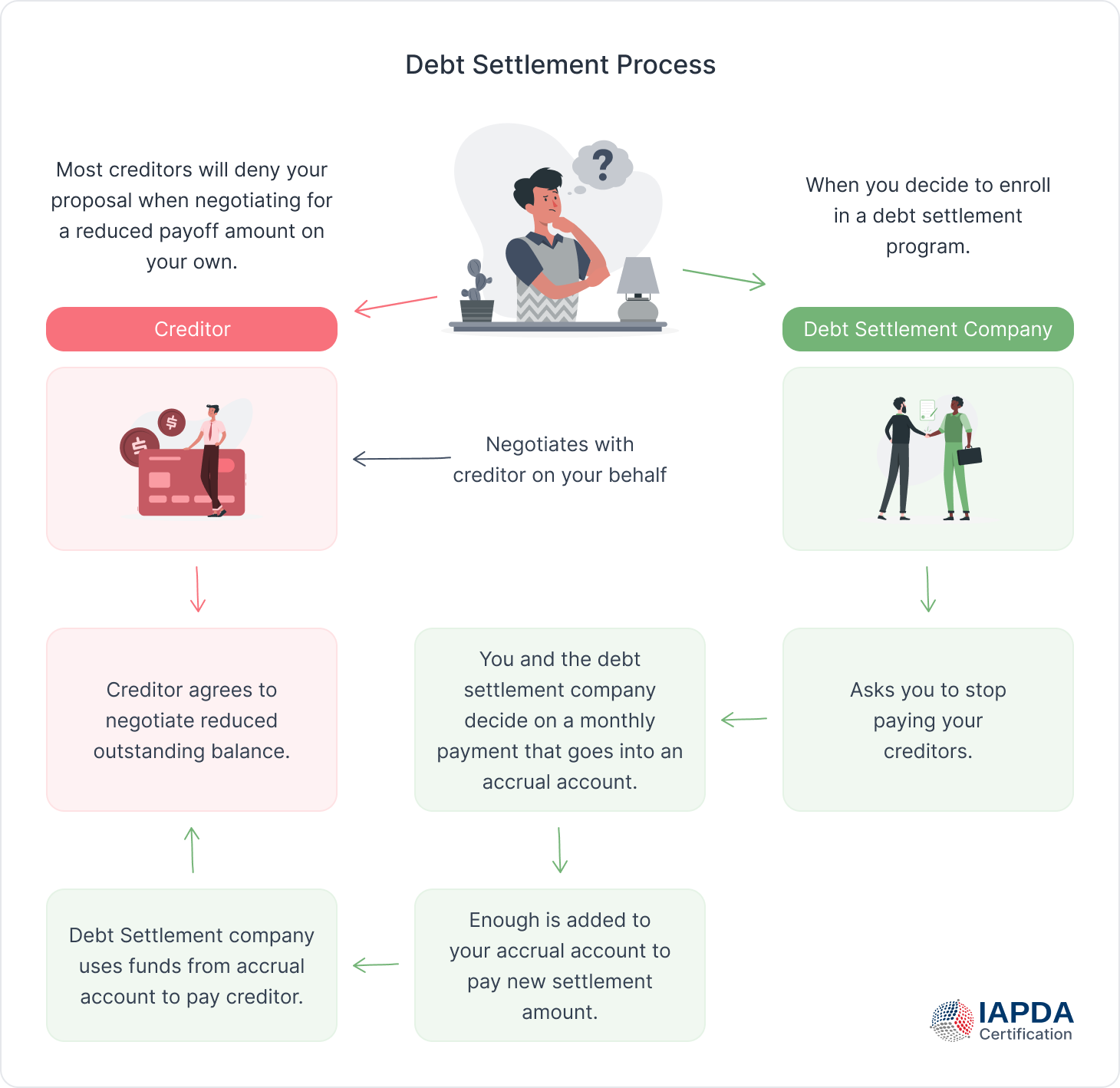

A debt settlement program is a way to reduce the amount of debt you owe by negotiating with creditors to take a lump-sum payment that is less than what you originally owed. Debt settlement programs can be an effective way to reduce the amount of debt and save on interest. Sometimes known as debt relief or debt adjustment, debt settlement is usually handled by a third-party company.

The process of debt settlement when using a professional company typically involves the debtor providing the company with details of their debt, such as the amount owed, the creditor, and any other relevant information.

The debtor will make monthly deposits to a neutral account to accumulate funds. The company then negotiates with the creditor to reduce the balance owed. Once a creditor agrees to accept a percentage of what is owed, the funds are paid from the neutral account usually in installments, and the remaining debt is considered settled.

Working with a professional debt settlement company can greatly reduce the stress associated with dealing with debt, as the company will handle the negotiations for the debtor. Your odds of success are greatly improved as these companies have established working relationships with your creditors.

A debt settlement company is permitted by law to charge fees only when the debtor agrees to the settlement amount and the debt is successfully settled. Fees are generally a percentage of the amount of debt settled.

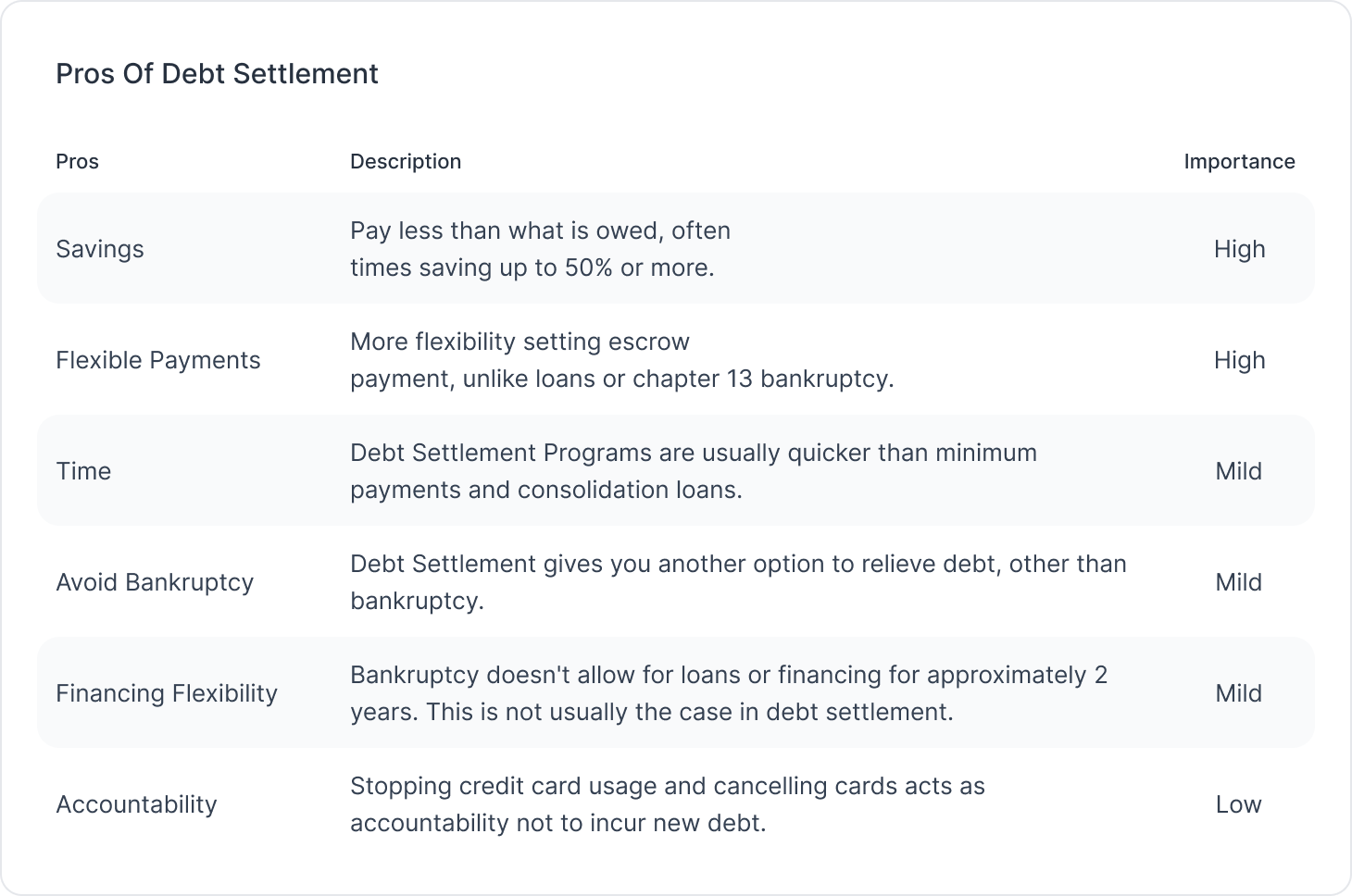

Top Pros and Cons of Debt Settlement

Pros

- LOWER your debt

- AVOID bankruptcy

- FEND OFF debt collectors

- Can IMPROVE your CREDIT SCORE long-term

Cons

- NEVER a guarantee

- Could face MORE FEES and INTEREST if you stop payments

- Could FACE FEES from debt settlement company

- Can HURT CREDIT SCORE short-term

Bankruptcy

This is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor.

For more information on Bankruptcy click here:

https://iapda.org/bankruptcy