Debt Collection

Understanding how Debt Collection works provides the confidence needed to address any Debt Issue

The Collection Industry

Certified Debt Specialists would be at a significant disadvantage in negotiation without a thorough understanding of the Collection Industry, its background, practices and priorities. This section of the training focuses on Collection, Creditors, Collectors and Attorneys. Background - Defining the Basics of the Collection Process:

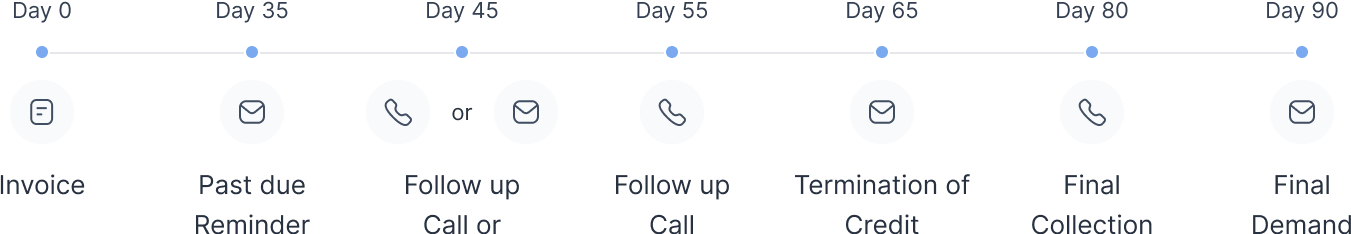

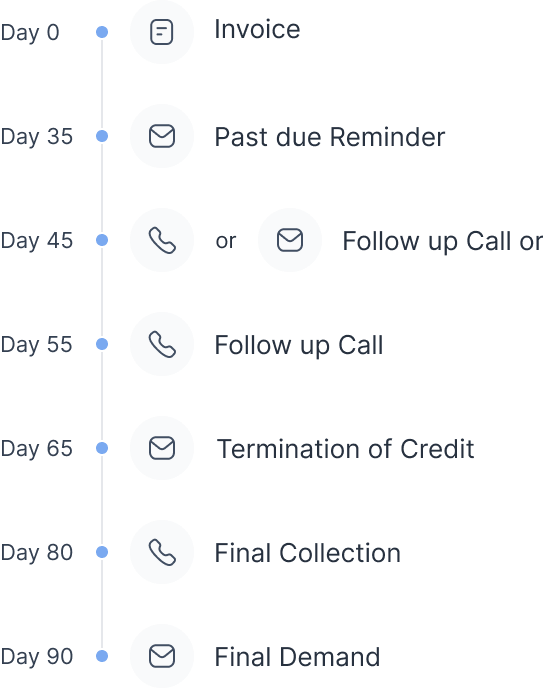

Firstly, let’s list the process that collection follows in simple numeric order:

The Collection Process

- Payment Missed - Friendly Reminder

- Payment still not made - Another friendly reminder

- Payment still missed - Possible Phone call

- No Payment received - Firmer letter (revoke credit, etc....)

- No Payment - In-house collection

- Still no Payment - Collection Agency

- Process starts again (letters, calls...)

Types of debt Collection

Internal

Debt collection often starts with the company you own. Their internal collection team(if applicable) will contact you about the debt, leading up to the charge off stage.

Third-Party

Third-party collectors will take over the account on behalf of the original creditor. This group represents "traditional" collection as most of us think of it. This group is regulated by the FDCPA

Debt Buyers

Debt buyers purchase old accounts in portfolios and even in online auctions at pennies on the dollar. They continue to collect the debt, sometimes even after the statute of limitations has passed.

The system of negotiation that we use to deal with our client’s debt follows the same rules whether we are dealing with the Creditors accounts department, with a third party collector/collection agency or Attorney.

Questions and Answers About Debt Collection

From obtaining business to receiving payments, debt collection may be one of the nation's most misunderstood professions. Defining the basics--what collection professionals do and how they work--is the first step toward providing a clear picture of one of society's most misunderstood industries.

What is a professional debt collection service?

Third-party debt collection services collect on past-due accounts referred to them by various credit grantors--including credit card issuers, banks, car dealers, retail stores, healthcare facilities, funeral homes--any business that extends credit or offers payment installment plans.

What does a typical professional collection office do?

Often creditors cannot locate their consumers because they move or change their phone numbers. The first thing a collection service must do is locate the consumer's current address or phone number through a process called skiptracing. The collection office then sends the consumer a notice that allows him or her to dispute the validity of the debt and/or request verification of the debt. Once the notice is received, a collector may call or write to the consumer and ask for full payment of the debt. If payment in full is not possible, the collector will use many tactics to try to collect the outstanding debt. The collection agency only gets paid when outstanding debt is collected and the amount of payment is based on the amount collected, so the motivation is to collect as much as they can persuade the debtor into paying in as short amount of time as possible.

Why are accounts referred for collection?

Most accounts are referred for collection because they have gone unpaid for an average of four to eight months and the creditor has not received any communication from the consumer. Since third-party collection services use specialized phone systems, computers and software designed specifically for the collection industry, along with proven collection tactics, they are more effective than credit grantors at retrieving payment on delinquent accounts.

What's the difference between in-house collections and a third-party collection?

Third-party collectors are directly regulated by the Debt Collection Practices Acts, (Both in U.S. and Canada) , which is administered by the Federal Governments. The Acts set forth strict guidelines designed to protect consumers from abusive, misleading and unfair debt collection practices. Credit grantor collection techniques are covered by law only under certain conditions.

Is there a typical debtor?

No. People from all walks of life face financial problems. These problems can stem from poor money management and budgeting skills to from unforeseen circumstances. Statistics in North America show that of all DEBTORS IN COLLECTION, 87 % live month to month on the edge and a major expense like an automobile repair will put them over the edge, 10 % are in collection due to a major disaster in their lives such as divorce, job loss or health issue and the other 3 % are people who plan not to pay their debt obligations.

What about those who have fallen into debt because of unexpected or catastrophic events?

The collection industry Code Of Ethics requires Debt Collector members to "show due consideration for the misfortunes of consumers in debt and to deal with them according to the merits of their individual cases. Because every account is unique, collection professionals are supposed to carefully listen to the consumer's situation, and find a mutually agreeable solution to their individual payment problems. This is often not the case as the Collection Agency is a “For Profit” business who only get paid on the collection of the debt and cases need to be dealt with as quickly as possible, so the intimidation tactics are their most effective tools, and some agencies rely heavily on these tools.

How has the collection industry changed over the past several years?

In addition to more thorough training in the most effective tactics for collection agents, the greatest changes in the collection industry resulted from a significant increase in automation. Several years ago, most collection offices kept track of accounts on paper cards, information was recorded manually and collectors dialed their phones themselves. Today, offices are computerized and use collection-specific software and sophisticated telephone systems with automated dialers. The typical collection agency is a collection of computer terminals, telephone headsets and a pressure environment to collect with more pay and bonuses going to the most aggressive collectors.

What can you do about bill collectors? (3rd party article)

Or the collection agencies as we call them. If you are one of those unfortunates who must deal with these fellows bear in mind that preparation is the name of the game. You must prepare yourself for their tactics and make a case for the settlement you wish to make. Collection agencies only get paid when they collect; so the more they can get the more they earn. Here's where you have to stand firm and not let them get you to repay the entire debt. Professional debt negotiators are invaluable to debtors in this regard.

The negotiator's weapons for dealing with the collection agency is to state that you want to be fair to all of your creditors, but you only have so much money to give to each. And if all of them decided to use a collection agency to get their money you might be forced into bankruptcy. If you need to deal with the bill collector personally, then address him courteously, pointing out the reasons why you were late and the settlement you wish to make. You must sound convincing to get his attention. If the bill collector refuses to go along with your idea, make sure you leave him with a good taste in his mouth. That is, you've treated him with respect and appreciate the reception he gave you.

Suppose the collection agency won't accept any of your proposals. Suppose the collection agency says they are going to take you to court to collect. Then your next recourse is to employ the services of a Professional third party negotiator to work out a settlement plan . The negotiator will tell the bill collector (collection agency) that you'd much rather settle the matter before it goes any further. Both of you can avoid a lot of trouble by making a reasonable settlement.

Why make an offer at all?

You want to prevent your having to apply for bankruptcy. What's more, the creditor will be happier to deal with a settlement payment which pays off the debt. He gets nothing if you go bankrupt. And a bankruptcy on your record will be the worst thing you can do.

Bill collectors are not allowed to harass you if you don't want them to do so. The Fair Debt Collection Practices Act (U.S.) gives you the right to write the collection agency for whom the bill collector works and tell them to stop bothering you. You usually use this right when things get out of hand. You have the right to:

The letter must contain material which relates to your ability to pay, when and what you will be able to pay. State the abuse the collector has inflicted on you and your family and make a specific demand that the collector stop contacting you. You must be tough and stick to your guns at this point. Don't let them get away with it, The law is strictly on your side!

The law mentioned above protects you only from the BILL COLLECTOR being overly zealous. The CREDITOR can take up contacts with you without worry. Normally he doesn't do this when the collection agency tells him they couldn't collect. He just files it away for the future. And usually forgets about it. Unless one fine day he sees you driving an expensive car.

Below is another article on the subject, the laws mentioned although specific to certain jurisdictions are found in similar form in most jurisdictions in North America.

Fast facts: debt collectors article by the Editors of Nolo Press.

The law prohibits creditors from using abusive or deceptive tactics to collect a debt. The law, however, also grants powerful collection tools to creditors once they have won a lawsuit over the debt. Here are six frequently asked questions and answers about debt collectors.

Collection agencies have been calling me all hours of the day and night. How can I get them to stop contacting me?

It's against the law for a bill collector who works for a collection agency (as opposed to working in the collections department of the creditor itself) to call you before 7 am or after 9 pm. The law, the Fair Debt Collection Practices Act (FDCPA), also bars collectors from calling you at work, harassing you, using abusive language, making false or misleading statements, adding unauthorized charges and many other practices. Under the FDCPA, you have the right to demand that the collection agency stop contacting you, except to tell you that collection efforts have ended or that the creditor or collection agency will sue you. You must put your request in writing.

I'm also getting calls and letters from the collections department of a local merchant I did business with. Can I tell that collector to stop contacting me?

No, the FDCPA (Fair Debt Collection Practices Act) applies only to bill collectors who work for collection agencies. Several states, including California, Florida, Louisiana, Maryland, Massachusetts, Michigan, Oregon, Texas and Wisconsin, have laws which bar all debt collectors--both working for a collection agency and working for the creditor itself—from harassing, abusing or threatening you or making any false or misleading statement. These state laws, however, don't give you the right to demand that the collector stop contacting you. There is one exception: Residents of New York City can use a local consumer protection law (Rules of the City of New York sec. 5-77(b)(4)) to write any bill collector and say "Stop!"

I just got a form collection letter with a lawyer's mechanically reproduced signature on it. Is this a legitimate collection technique?

Perhaps not. Under the FDCPA (Fair Debt Collection Practices Act), a lawyer must review each individual collection case before putting his or her name on a collection letter. The lawyer can't simply authorize that a form letter be sent and then let the bill collector send it, with the lawyer's signature, if the lawyer hasn't reviewed the particular debtor's file. To put a stop to it, you may be able to sue the lawyer for up to $1,000 in small claims court for violating the FDCPA.

A bill collector insisted that I wire the money I owe through western Union. Am I Required to do so?

No, and it could add a lot to your debt if you did. Many collectors, especially when a debt is more than 90-days past due, will suggest several "urgency payment" options, including:

- Sending money by express or overnight mail - this will add at least $10 to your bill; a first-class stamp is fine.

- Wiring money through Western Union's Quick Collect or American Express' MoneyGram - Another $10 waste.

- Putting your payment on a credit card not at its maximum - You'll never get out of debt if you do this.

I've moved a lot and recently heard from a collector on a bill that's almost three years old. How did the collector find me?

In this technological age, it's easy to run but harder to hide. Collectors use the following primary resources to find debtors:

- relatives, friends, neighbors and employers - collectors pose as long-lost friends to get these people to reveal your new whereabouts

- post office change of address forms

- state motor vehicle registration information

- voter registration records

- a former landlord

- banks

Can a collection agency add interest to my debt?

Not unless it was called for in your original agreement or allowed under your state's law. Many states do authorize the collection of such interest. In California, for example, collection agencies can add interest because the Civil Code (sec. 3289(b)) permits a creditor to charge interest after default, even if the contract is silent.

To learn about the psychology and mindset of debt collection training and debt collectors click here.

Consumer protection

Fair Debt Collection Practices Act

The types of damages that can be compensated here include:

- Statutory Damages. A collector who violates the FDCPA may owe statutory damages of up to $1000 to the debtor.

- Attorney’s Costs and Fees

- Monetary Losses. If a consumer is tricked or forced into paying a collector the consumer does not actually owe, a consumer may be able to recovery those funds.

- Emotional Distress. A collector’s behavior can also result in stress that can negatively affect the debtor’s emotional wellbeing. Calls to the debtor, their family members, and co-workers can take a toll on professional and personal relationships.

Most Common FDCPA Violations

- Continued attempts to collect debt not owed - Consumers are constantly being contacted about debts they either paid off a long time ago or debt that is not even theirs to begin with.

- Illegal or unethical communication tactics - Callers are reported for using threats or obscene and profane language.

- Disclosure verification of debt - The agency fails to send a written debt validation notice including the amount of the debt, name of the creditor, and a notice of the consumer’s right to dispute the debt within 30 days.

- Taking or threatening illegal action - The agency threatens to sue the consumer even though the debt is too old and the statute of limitations to sue has expired. Agencies have also threatened to garnish a consumer’s wages or to confiscate the consumer’s home or personal property.

- False statements or false representation - The collection agency states or implies that it is a law firm. Some consumers also complain that the agency is attempting to collect an amount greater than what is actually owed.

- Improper contact or sharing of info - The agency informs a third party of the debt without the consumer’s express written permission. They are allowed to inform the consumer’s attorney, the creditor, the creditor’s attorney, a credit reporting agency, the consumer’s spouse, the consumer’s parent (if the consumer is a minor) without permission.

- Excessive phone calls - The collection agency makes several calls a day, and sometimes several calls in a row.

Fair Credit Reporting Act

The types of damages that can be compensated here include:

- Actual damages. These are damages that can be proved because of harm caused by an action or failure to act by the agency, business or individual. There is no limit to how high an award can be.

- Statutory damages. These are damages that don’t require proof, but the compensation is limited to somewhere between $100 and $1,000.

- Punitive damages. These are awarded to punish an agency, business or individual and deter them from violating the FCRA again. There is no limit on how much can be awarded.

- Attorney fees and court costs.

Most Common FCRA Violations

- Failure to update reports after completion of a consumer negotiated account is, by far, the largest example.

- Agencies might also report old debts as new and report a financial account as active when it was closed by the consumer.

- Creditors give reporting agencies inaccurate financial information about you.

- Agencies fail to follow guidelines for handling disputes.

- Reporting a debt as charged off, when it was settled or paid off.

- Reporting late payments when your payments were timely.

- Reporting that an account was active after it was voluntarily closed by a consumer.

- Failure to report that a debt was discharged in bankruptcy.

- Reporting information that is more than seven years old (when Chapter 13 bankruptcy notices should lapse) or 10 years old (Chapter 7 bankruptcy).

- Reporting Debt that has passed the statute of limitations in that consumers state. (each state varies) Inaccurate statement of balance due.

Telephone Consumer Protection Act

Penalties associated with violations of the TCPA can include $500 per violation and up to $1,500 per willful violation.

Most Common TCPA Violations

- Calls or texts to those listed on the National Do Not Call Registry.

- Unsolicited calls to residential or cell phones using automated dialing or pre-recorded messages.

- Unsolicited texts to cell phones.

- Companies (using ATDS or pre-recorded message) must identify themselves at the beginning of the message/call.

- They must also provide a telephone number for customers to contact (which cannot cost a caller more than the local or long-distance call charges).

- Companies must also necessarily provide an option to make a do-not-call request.

Schedule a free consultation with an experienced consumer protection attorney

If have been contacted by a debt collector that you believe was in violation of the FDCPA or TCPA, we would like to hear from you. There is a good chance of receiving compensation for the harassment. It is important to us that your rights are protected, and we are here to assist you in addressing any concerns or issues related to such violations.